| Big Business |

|

followthemedia.com - a knowledge base for media professionals |

|

|

AGENDA

|

||

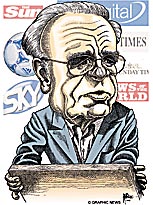

For Knight Ridder There Was Next To No Premium; For Tribune There Was Next To No Premium; But For Dow Jones Rupert Murdoch Offers a 65%+ Premium. Think He’s Interested In Doing This Deal?In an absolutely astonishing, but an extremely savvy move, Rupert Murdoch has made the Bancroft family an offer for Dow Jones that if considered on financial grounds alone is going to be hard to refuse. It boils down to whether the family is more interested in retaining legacy, no matter the financial enrichment the family would earn from the deal, or is it time to take the money and run? (c) graphicnews.com, used with permission For the industry, is this a one-off because Murdoch has a use for Dow Jones, or is the very fact that Murdoch has offered so much for primarily a newspaper company sending a message to all investors that the newspaper dunking of past years is overkill, and there is far more value in newspapers than Wall Street gives the sector credit? The Bancrofts will have to weigh that in their decision. If they turn Murdoch down are they again a $32 share at a time Murdoch offered $60, or has that $60 offer boosted newspaper shares on Wall Street so that even if they turn Murdoch down the shares, while retreating, won’t go back to where they were? Initial reports said that Bancroft family members owning more than 50% of the voting shares opposed the deal. At $60 a share Murdoch has forced the family to search their inner souls to ask themselves what is more important – making a big profit based on the premium, or is the influence of owning The Wall Street Journal and Barrons and other assorted media worth turning down huge profits?

Dow Jones is playing it cool, simply saying it is evaluating the proposal and “There can be no assurances that this evaluation will lead to any transaction.” Dow Jones has a two-tier share system in which the Bancrofts hold the company’s voting power via their B shares. If they do turn it down then they will need some very good reasons for the securities authorities on why the deal was not considered to be in the best interests of the shareholders. In a rising stock market over the past couple of years newspaper shares have been hammered to lows not seen in many years. The lower share prices are exacerbated by traders who have been selling newspaper and other media shares short by borrowing a security and selling it immediately in the hope of being able to buy it back a few days later at a lower price with the difference going in the trader’s pocket. Take Dow Jones, for instance. The shares closed Monday at $36.33. If a trader borrowed 10,000 shares it would have cost $363,300 but if the shares were to fall by $1 in a few days the trader could buy at that lower figure, pocket $10,000 and return the borrowed shares. But because those shares took off like crazy on word of the offer Tuesday anyone who had been looking for a lower price for a profit, suddenly had to buy in the market at any price to limit the loss. And a lot of people had to do that with newspaper shares Tuesday. And it’s not just happening with Dow Jones shares. If Murdoch offers a big premium for DJ, then some believe that other companies could be put in play such as the likes of The New York Times Company, or The Washington Post? Maybe those companies might even try and trump Murdoch? It’s just too much positive news for the sector and it spelt disaster for the “shorts” who lost fortunes on what they must surely consider Black Tuesday. Most newspaper shares had their biggest gains in recent memory Tuesday, including Dow Jones that ended up 54.7% at $56.20, a $19.87 gain. The New York Times closed up 6.53% (the last time it had a rise like that was in February on unsubstantiated rumors Warren Buffett was sniffing around), the Washington Post closed up 2.86%, Gannett, the country’s largest newspaper publisher, closed up 4.95% and even McClatchy which hit an eight-year low last week was up 3.53%. But in after hours trading those shares all dropped a bit, some by more than 1%, indicating the smart money says the Bancrofts are turning the deal down, but there’s always a chance Murdoch will increase the offer or someone else steps in with a higher offer, although on the financial fundamentals that would be difficult to fathom. The buying fever was not just for US newspaper shares. Companies like the UKs Reuters (financial information) rose 3.64%, and Pearson, owner of the Financial Times, rose 4.96% -- the sentiment being that if one financial news company was possibly in play, then why not others, but also because the “shorts” were caught out. If there was a day that newspaper publishers could watch with glee what was happening to the professionals on Wall Street who have been damning their industry for so long, then Tuesday was it. But for all of that, why does Murdoch want Dow Jones, and why offer such a large premium, especially when he has been very public that his media vision for the future is digital, not paper? Why Dow Jones? Because Murdoch has advanced plans to launch in the US a business news cable channel that will take on market leader CNBC. Carrying the Wall Street Journal brand onto that channel and making use of Dow Jones resources around the world immediately gives that new channel credibility. Also Murdoch owns just one daily US newspaper, TheNew York Post. Not the most prestigious of publications. But to own The Wall Street Journal, quite possibly the most prestigious newspaper in the world, well that’s something different. And Dow Jones is not all paper. It owns the Marketwatch web site which would have great synergy for a new cable TV business channel. The Journal’s own web site, the only full subscription daily newspaper web site in the US, is showing rapid growth whereas others such as the New York Times are reporting digital growth slowdowns, and DJ recently took control of Factiva, a news aggregator that had been owned 50-50 by Dow Jones and Reuters. And why offer such a premium? Because Murdoch has obviously decided that making use of Dow Jones for his cable channel is the most financially feasible way forward, but to get the Bancroft family to even look at what’s on the table he had to offer so much that they couldn’t just say, “Go Away”. One possible fly in all this ointment is Murdoch’s wanting to use The Wall Street Journal brand with his new business cable channel. That could run into difficulties because Dow Jones has an agreement with CNBC for that very same purpose that runs through 2012. In 2005 Dow Jones, as part of its cost-cutting program, transferred its 50% equity interests in both CNBC Europe and CNBC Asia, as well as its 25% interest in CNBC World, to NBC Universal for what it called “nominal consideration”. Dow Jones had lost some $17 million in 2004 on those holdings. No longer did the CNBC logo carry that Dow Jones was an owner, but there was an agreement between the two parties for Dow Jones to still be involved editorially. It didn’t take long for union employees at Dow Jones to turn both thumbs down on the deal. “Mr. Murdoch has shown a willingness to crush quality and independence, and there is no reason to think he would handle Dow Jones or The Journal any differently,” the Independent Association of Publishers’ Employees said in a statement. “Despite our differences of opinion with current management, we strongly encourage the Bancrofts to continue to stand up for the institution's independence, and to walk away from this offer. With media companies making out like bandits on the stock exchange, for one day at least, spare a thought for News Corporation. Its shares actually sank 4.21% but gained a bit after the markets closed, again indicating the smart money says the deal will not go through. Then again, there was a lot of “smart money” in shorting media shares. See also: Murdoch's interview with his Fox News Tuesday afternoon on why he bid so much and why he hopes he succeeds |

| copyright ©2004-2007 ftm partners, unless otherwise noted | Contact Us • Sponsor ftm |